The NEM is an important enabler of the energy transition

by Greg Williams

Senior Economist

Everywhere in the world, electricity generation and use are undergoing fundamental change. This transition toward a low emissions power system naturally engenders debate about the value of the existing market framework. If you have read anything about the energy transition in Germany, you might get an impression that the transition there is orderly and well managed in comparison with Australia. However, there are some advantages of the NEM that appear only when you pan back a little.

Germany’s power system is just one part of the European interconnected power system and each country has its own brand of market and ideas about how the transition should occur. The French market is quite different from the German market and the Nord Pool market in Scandinavia. However, their electrical ties and the significant quantities of electricity flowing between countries oblige them to collectively agree at least the quantity and value of that electricity. The single European electricity market has evolved slowly over the last 30 years and settles quantities of and prices for cross-border electrical flows.

Those electrical ties are particularly important during Germany’s transition (Energiewende) as it is changing the electrical flows in and out of the country. For instance, a report notes that, due to network limitations, peaks in offshore wind generation are spilling over into Denmark, Poland, the Netherlands and beyond. At times, the report indicates that Germany is even paying wind turbines in Denmark to switch off to make way for German electricity exports.

Similarly, in Australia, the Commonwealth and state governments each have their own ideas about how to make the transition happen. Each government has issued a variety of policies that discourage fossil fuel activities and encourage low emissions technologies (for example, subsidised battery and rooftop solar PV installation and feed-in tariffs).

However, just as it does in the European market, electricity flows between the states in the national electricity market (NEM) in Australia. When the weather conditions are favourable (that is, the sun is shining and wind is blowing), electricity flows out of South Australia into Victoria and further, allowing other regions to enjoy the benefits of low marginal cost renewable electricity. When it is unfavourable, South Australia imports any shortfall in locally produced electricity from other regions. It is these flows between regions that demonstrate the value each region is getting from the NEM. When flows between regions are constrained, mutually beneficial trade is also constrained and society is worse off.

Properly valuing the electricity flowing between countries in Europe and the states in the NEM requires rules that decide how much a generator should be paid as well as who pays and how much they pay for the electricity generated. Prices calculated from these rules are the prime motivator for companies to generate electricity at its lowest cost for the benefit of consumers who value it most.

European countries have work still to do to harmonise intraday and real time market rules to efficiently value unforeseen variations of electrical flows between each market to more efficiently manage increasing amounts of renewable generation subject to imperfect weather forecasts. Over a day, a month or even a year, the benefits of freeing up efficient electricity trading between countries/regions, may not make a large difference to electricity bills. However, they add up over time and consumers in the five regions of the NEM have already been enjoying the benefits of a single market for over 20 years, with one set of rules designed so that electricity flows efficiently from where it is most cheaply being generated to where it has the most value.

Improving the links between wholesale and retail signals

While Australia is obviously not alone in undergoing a transition to low emissions electricity sources, it is undergoing its own unique brand of it. Here, in Australia, rooftop solar PV is a particular focus of that transition – much more so than in other countries – due to the abundant sunshine we enjoy. The NEM experiences peak demand of around 34 GW supplied by 48 GW of generating capacity. In its Renewable Integration Study: Stage 1 report, the Australian Energy Market Operator (AEMO) states there is already 9 GW of rooftop solar PV and this is forecast to grow to 14 GW or more in the next ten years. This report looks at the impacts of this growth on the power system but what impact will it have on the electricity market and customer bills?

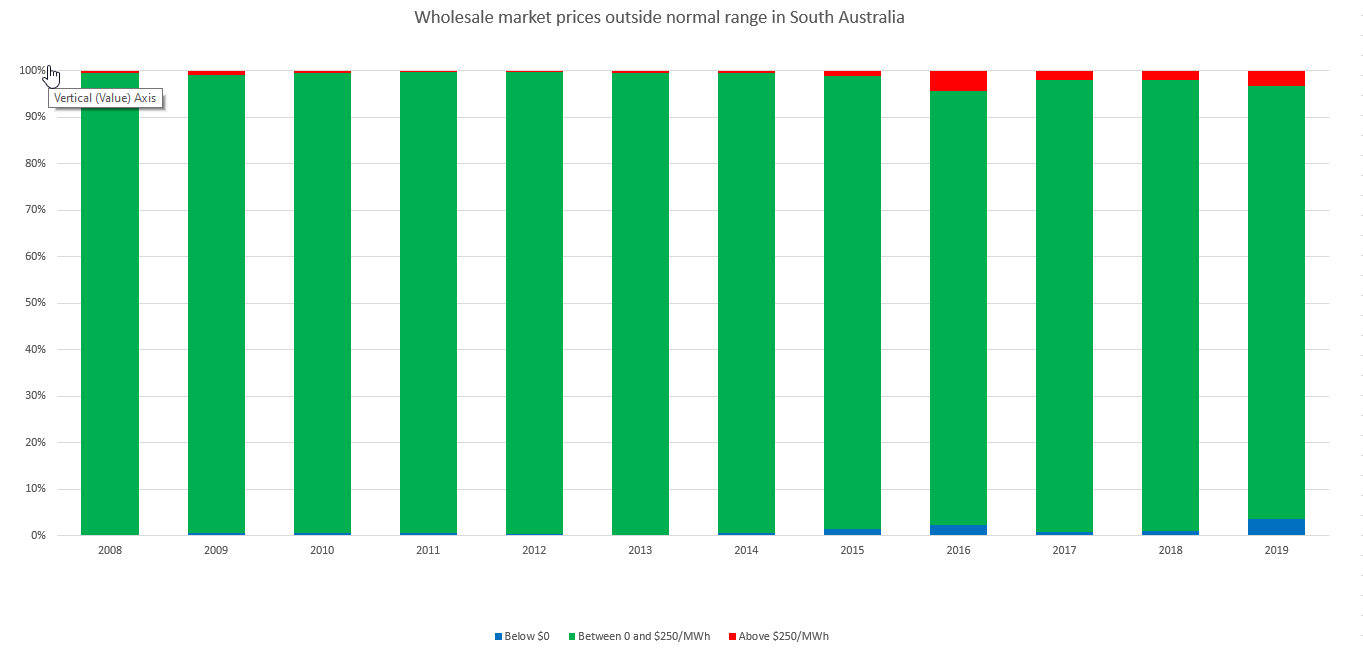

What is generally agreed by AEMO and others is that the uncertainty of weather-based generation, including rooftop solar PV, will create more volatile spot prices. An indication that this is occurring is an increase in the number of periods where prices vary outside a range that might represent a fair reflection of variable costs of electricity generation.

This outcome is neither good nor bad, it is merely the out-turn from a change in generation resources and patterns. Increasing the variable output of of weather-reliant resources, while keeping consumption patterns largely the same, requires other generators to vary their output more to ensure generation and demand remain in balance.

Increasing the amount of generation performing this balancing role, increases the cost of that service, which translates into a greater variation in the value of electricity in the wholesale market. There is a working paper online by Akshaya Jha and Gordon Leslie that looks at data from the Western Australian market and finds the data supports this logic. Specifically, the paper finds that increasing renewable generation during the day has lead to price increases in the evening peaks.

The chart above also indicates outcomes consistent with this dynamic. The chart groups five-minute prices in South Australia within and outside of a normal range (that is, the majority of prices somewhere between $0-250/MWh shown in green). Prices outside this normal range signal relative abundance (prices below zero shown in blue) or scarcity (prices above $250/MWh shown in red).

The chart shows that there is an increasing share of red (very high) and blue (very low) prices. Viewed as a glass half full, this signals a growing opportunity for customers, communities and generators to:

- buy more electricity on the spot market when prices are below the cost of generating it themselves

- generate more and consume less when prices are above the cost of generating it themselves and greater than the value of consuming it.

These variations in quantities and prices, rather than creating the impetus for disconnecting from the wider grid, reveal why being connected is valued and valuable. After all, these variations are created by the actions of customers, communities, states and the generators that supply them. It would only be economic to disconnect if the benefit from exporting electricity and buying lower cost electricity is outweighed by the cost of connection (that is, in network charges). This is unlikely unless renewable electricity can be produced at low cost and in quantities that match the demand from customers where and when they want it. Rooftop solar PV fulfils the first criteria of being low cost and, to a degree, it is produced where customers want it, but it is limited in its ability to generate electricity when people want to use it.

Nevertheless, most retail customers continue to pay and be paid fixed prices that have little in keeping with those in the chart. These fixed prices average out the actual variation in wholesale prices. Also, the fixed prices retail customers pay for consumption are much higher than the prices they are paid for exporting solar electricity they generate back to the grid. This is because distribution networks charge retail customers for electricity consumed but not exported.

Fixing prices for retail customers may do little harm when the variation of wholesale prices is at or below present levels shown in the chart above. However, as the transition continues and if nothing else changes, the increasing uptake of rooftop solar PV generation will lead to:

- other resources being paid increasing amounts of money to vary their output (or discharge/charge a battery) to compensate for solar PV generation patterns being poorly matched with consumption patterns, increasing the variation seen in the chart above

- increasing investments in the distribution network to accommodate all the electricity being generated by customers, increasing network charges paid by all customers.

Therefore, absent changes to tariffs, the very thing customers are doing to reduce their own electricity costs (investing in solar PV) could contribute to higher electricity costs for all. The fixed prices charged to retail customers would continue to rise because the increase in the volatility in wholesale prices would cause a net increase in the average price (high prices outweighing impact of negative prices). They would increase further from any investments in the distribution network because network charges are, in part, recovered from retail customers as a charge on electricity consumption. At the same time, the fixed prices paid to retail customers for their solar PV generation would tend to decrease as the value of generation produced during the day decreases as total solar PV generation increases.

Because of this potential, it is fortunate then that the industry is working on projects to reform network access and pricing designed so that customers receive and pay prices which better reflect the value of their electricity at the time and location it is generated or consumed. For further examples, see: