Glimpses of a new market dynamic in Queensland

By Oliver Nunn, Senior Economist, AEMC

29 August 2019

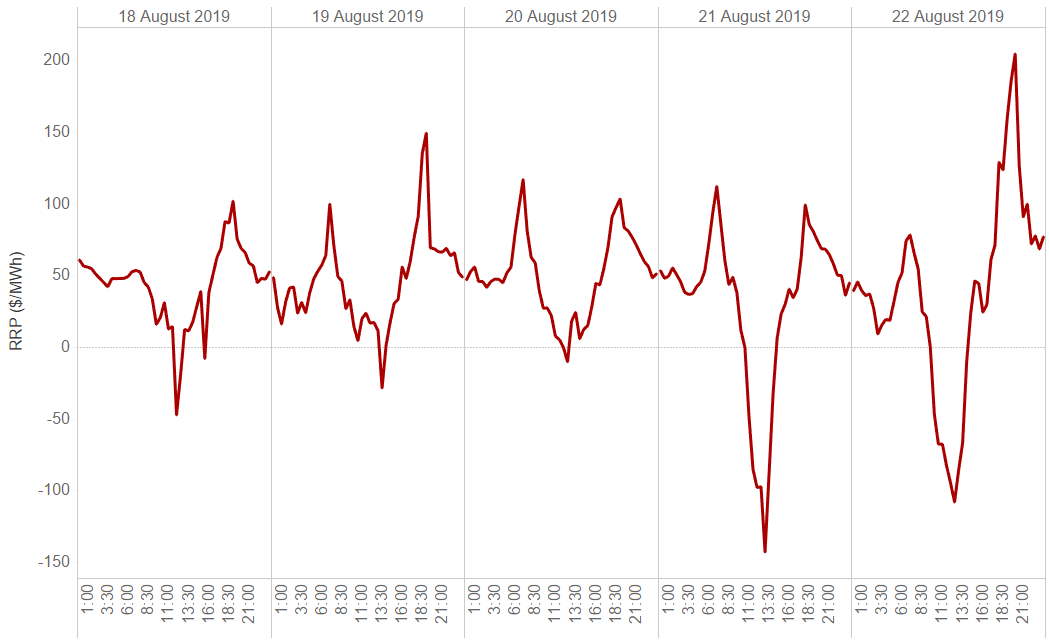

The talking point of the last week has been the negative prices seen in Queensland during the middle of the day. Figure 1 shows the Queensland price on a 30-minute basis for the last five days – prices have fallen to negative levels around noon every day.

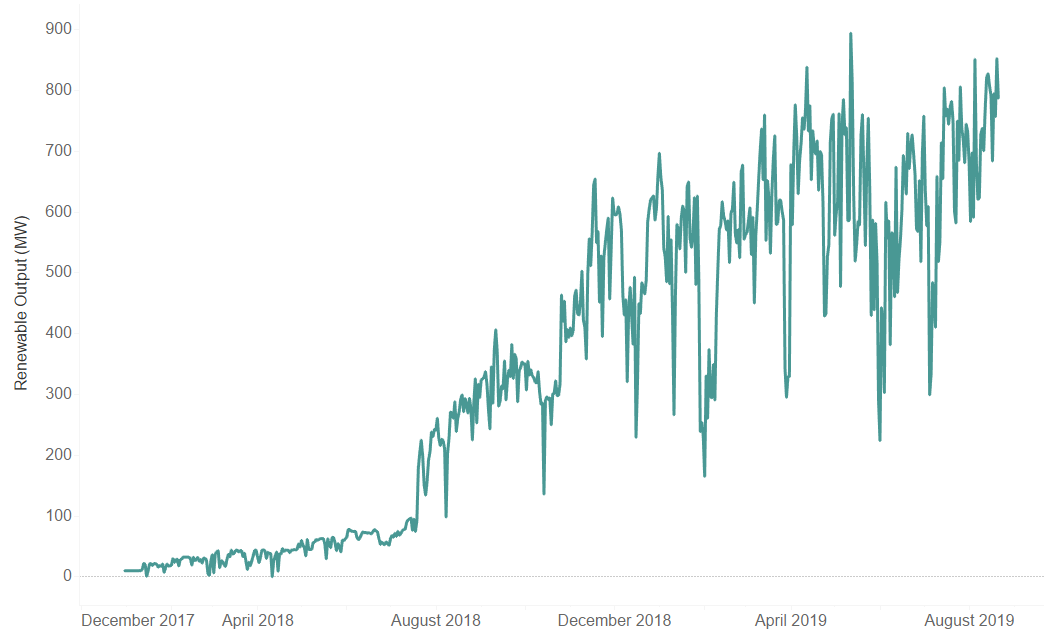

The obvious cause is the rise in large-scale solar generation. Figure 2 shows the output of all renewables in Queensland during the half-hour from noon to 12:30 pm for the last couple of years. Renewable output has reached record levels because a number of large-scale solar farms have come online.

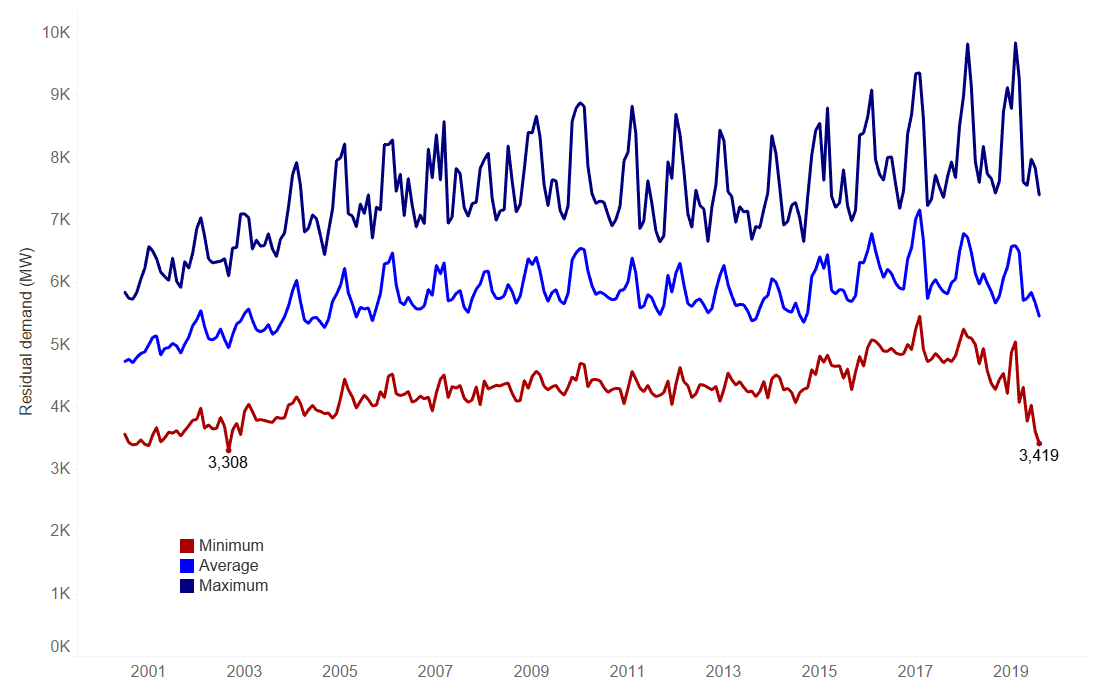

What is this doing to the residual demand for energy in Queensland – that is, demand minus the output of all semi-scheduled generation? Figure 3 shows the average, maximum and minimum residual demand for Queensland on a monthly basis going back to 2000. The values for residual demand seen in August last week are the lowest levels since September 2002, bearing in mind that in 2002 there was no semi-scheduled generation in Queensland.

To summarise, the negative prices seen in Queensland during the middle of the day have been accompanied by 17-year lows in residual demand. Around 3500 MW seems to be the tipping point where prices become negative in Queensland. We may be seeing the first glimpses of a new market dynamic. More small-scale solar PV and more large-scale renewables can only be expected to fuel this new trend.

Economists Corner

This information is prepared by the AEMC’s Strategy and Economics team. It does not necessarily reflect the views of the Commission.