Hydrogen: the role of the hydrogen production industry in providing system services to the NEM

by Tom Meares, James Tyrrell and Russell Pendlebury

This second article in our series on hydrogen and the NEM looks at the role hydrogen electrolysers can play in providing system services within electricity markets, the changes afoot in the NEM, and the way the current and future regulatory frameworks may facilitate greater sector coupling between the hydrogen production sector and electricity markets. AEMC Chair, Anna Collyer touched on this recently in her address to the Australian Hydrogen Conference on May 31st, 2022.

Introduction

With pilot projects like the Hydrogen Park South Australia 1.25 MW electrolyser starting up in May 2021 and larger projects such as AGIG’s 10 MW Murray Valley Hydrogen Park in Victoria in the planning stages, the question is more pressing than ever, what system services could electrolysers provide the NEM? What is the value to them in doing so, and how might the regulatory settings facilitate this shared benefit?

Hydrogen production facilities and their flexibility of operation

As the system transitions to lower-emissions energy and integrates higher levels of variable renewable energy (VRE), flexible load is likely to become increasingly important. It can help balance supply and demand, provide headroom to cover uncertainty, and manage system security, reliability, and network constraints in an economically efficient manner.

Peaking gas generators, pumped hydro, and battery storage systems are important sources of flexibility in the system, but flexibility can also be provided by hydrogen electrolysers. Electrolysers can ramp up and down quickly, have low minimum operating output, and the flexibility to operate above nameplate capacity for periods. This means they can offer several services of value to the grid: demand flexibility in response to rapidly changing or unexpected market conditions; demand shifting between seasons or periods of high or low VRE output; the relief of minimum demand conditions; frequency control ancillary services (FCAS), voltage control; network support and the relief of network congestion issues. Electrolysers can also sign up for contracts that help market participants manage increasing price volatility in the NEM.

Hydrogen can also fulfil a locational role in relation to the provision of a number of these services.

Types of electrolyser technology

There are four main types of electrolyser technology. They are typically differentiated based on the electrolyte and temperature of operation. Each of these has different operating capabilities and abilities to provide system services.

- Alkaline electrolysers (ALK). Commercially available for over a century.

- Polymer electrolyte membrane (PEM) electrolysers. More expensive than ALK electrolysers, they are also more compact, more flexible, and have a simpler design.

- Solid oxide electrolysis cells (SOECs). Have higher energy efficiency but are still in the development phase. Prone to faster degradation and shorter lifetimes.

- Anion exchange membranes (AEM). New technology, lifetime profiles remain unstable, and performance is not yet as good as would be hoped.

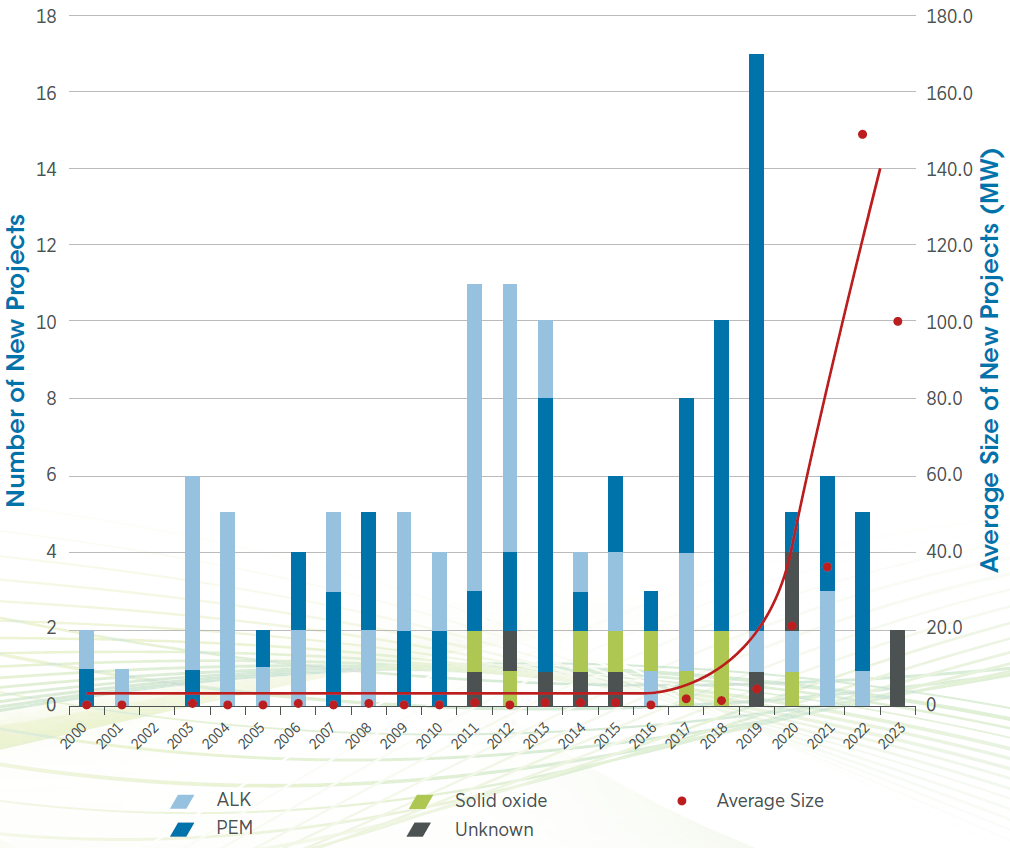

The below figure from IRENA shows that to date PEM electrolysers appear to have been deployed on the greatest scale.

Figure 1: Timeline of power-to-hydrogen projects by electrolyser technology and project scale

Source: Quarton and Samsatli, 2018 and IRENA Database

Table 1: Key characteristics of the electrolysers based on information from IRENA are summarised below.

| Year | Alkaline | PEM | AEM | Solid Oxide | |

| Operating temperature | 2020 | 70-90C | 50-80C | 40-60C | 700-850C |

| Load Range | 2020 | 15%-100% | 5%-120% | 5%-100% | 30%-125% |

| Load Range | 2050 | 5%-300% | 5%-300% | 5%-200% | 0%-200% |

| Electrical Efficiency (system) | 2020 | 50-78kWh/Kg H2 | 50-83kWh/Kg H2 | 57-69kWh/Kg H2 | 40-50kWh/Kg H2 |

| Electrical Efficiency (system) | 2050 | <45kWh/Kg H2 | <45kWh/Kg H2 | <45kWh/Kg H2 | <40kWh/Kg H2 |

| Lifetime (hours) | 2020 | 60,000 hours | 50,000-80,000 hours | >5,000 hours | <20,000 hours |

| Lifetime (hours) | 2050 | 100,000 hours | 100,000-120,000 hours | 100,000 hours | 80,000 hours |

| Stack Unit Size | 2020 | 1 MW | 1 MW | 2.5 kW | 5 kW |

| Stack Unit Size | 2050 | 10 MW | 10 MW | 5 MW | 200 MW |

| Cold start to nominal load | 2020 | <50 mins | <20 mins | <20 mins | >600 mins |

| Cold start to nominal load | 2050 | <30 mins | <5 mins | <5 mins | <300 mins |

| Capex stack | 2020 | USD270/Kw | USD/400/Kw | Unknown | USD>2000/kW |

| Capex stack | 2050 | USD<100/kW | USD<100/kW | USD<100/kW | USD<200/kW |

| Capex System | 2020 | USD500-1000kW | USD700-1400kW | Unknown | Unknown |

| Capex system | 2050 | USD<200/kW | USD<200/kW | USD<200/kW | USD<300/kW |

(Note: Discussions with industry indicate that cold start figures for PEM electrolysers are already below 5 minutes).

According to IRENA there is no single electrolyser technology that performs better across all dimensions. The future electrolyser technology mix will be driven by the needs of each specific development.

Timeframes for flexibility of hydrogen electrolysers

Electrolysers may offer the most value in bulk energy storage, or matching predictable changes in renewable generation output, versus the flexibility in the very short time scales (ie, sub-second) required to follow immediate wind and solar output changes. For large plants under development, there are options to provide some flexibility at very fast response rates. One example of this would be through a small on-site battery.

The flexibility provided by a hydrogen project can be varied through decisions on the size of the electrolyser, the nature of electricity supply, hydrogen storage and the flexibility of hydrogen offtake.

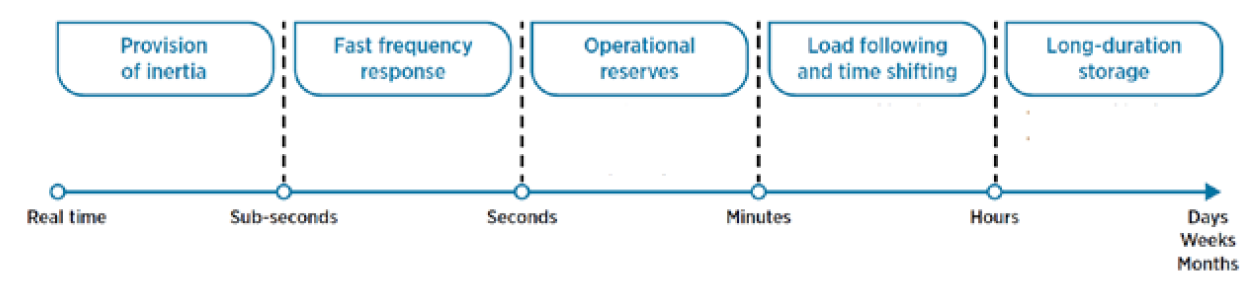

IRENA (2020) states that flexibility can be achieved at multiple time scales and electrolyser facilities can provide most system services, with the exception of inertia.

Figure 2: Power system services that can be provided by energy storage.

Source: Based on IRENA analysis, 2020

The primary objective of an electrolyser is to produce hydrogen. But as an additional bonus, they can offer grid services without too much technical adjustment to the core design.

Our current understanding is that while electrolysers are very flexible in short timeframes, they should not be run below certain levels for any one stack for an extended period. However, with larger electrolysers and large numbers of stacks at a single site, each stack can be switched off so the plant minimum rating can be very low as a percentage of overall capacity.

Flexibility to operate above nameplate capacity is constrained by the sizing of the balance of plant, beyond the electrolyser stack, and the economics of building the balance of plant in excess of normal operational requirements.

As a result, flexibility may be better focused on ‘turn-down’ rather than ‘turn-up’ capacity.

Within-day flexibility

Hydrogen electrolysers may increase power system flexibility and reduce curtailment in grids with significant amounts of VRE. They can do this by absorbing VRE output over daily timeframes, and by rapidly ramping up or down where needed.

Of course, electrolysers need to do this while maintaining the capacity factor on the electrolyser according to their project design, allowing for the nature of the power supply and the capital cost of the electrolyser.

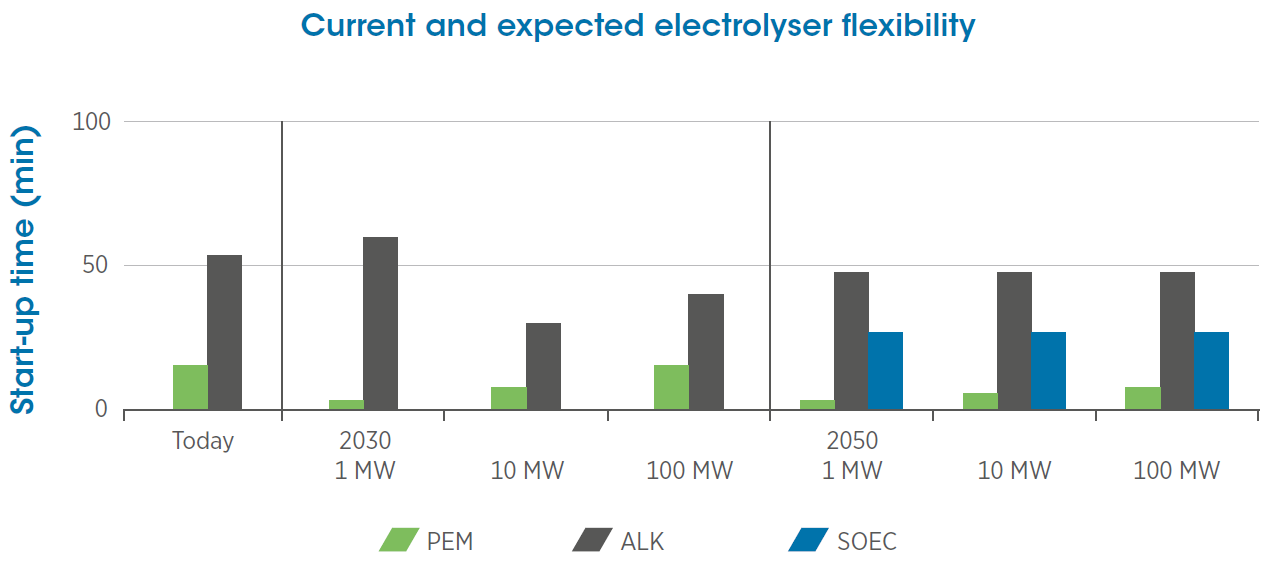

The ability of electrolysers to add demand-side flexibility to power systems is illustrated below:

Figure 3: Start-up times for electrolysers

Source: InWEDe, 2018

A PEM electrolyser’s ability to reach cold start-up in less than 5 minutes and shut down within a few seconds is a significant benefit when considering its capacity to provide services like demand side response. The value in ramping up to soak up excess solar PV may not require fast flexibility as the profile of solar generation is more predictable. The value in ramping up or down in seconds will be driven by FCAS values and the growing need of the system to manage increasing variability and uncertainty of generation and demand.

Seasonal flexibility

Electrolysis converts electrical energy into chemical energy by storing electrons in the form of stable chemical bonds. This chemical energy can be used as a fuel or converted into electricity when needed. (Yan et al. (2020))

The variable energy from renewables requires energy storage in the short and long term. Storage methods range from large-scale batteries to pumped hydro and gases in the form of natural gas or renewable hydrogen gas produced through electrolysis.

The key features that make hydrogen desirable for seasonal storage are:

- large energy capacity;

- locational flexibility

- minimal or no energy loss while stored

- ability to use existing infrastructure such as gas networks

- low capital cost of containing renewably generated fuels.

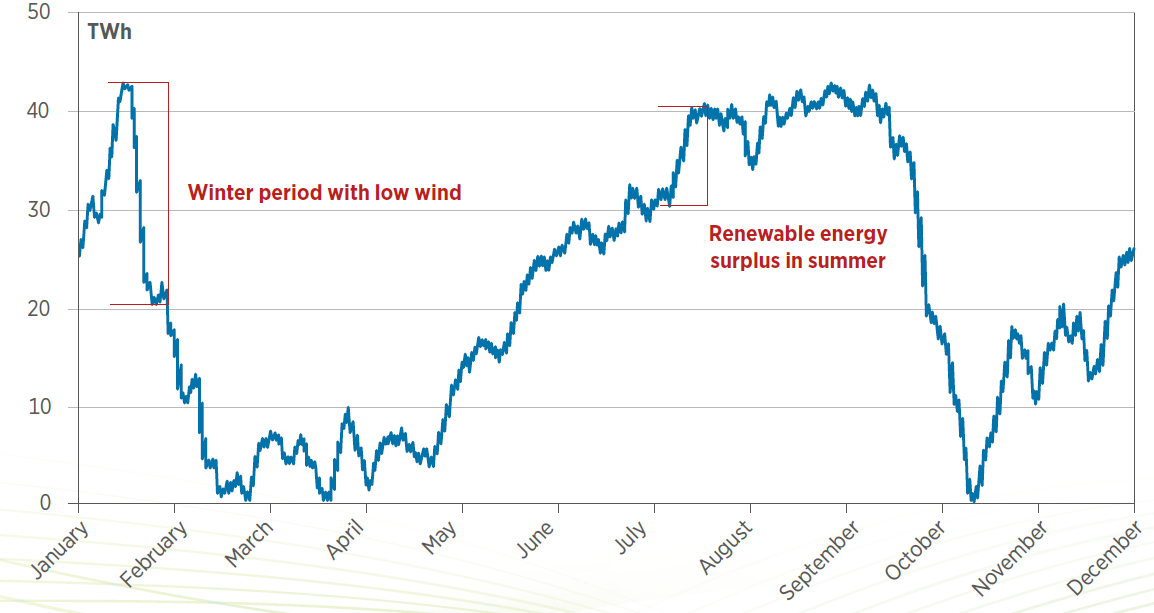

Storage needs for integrating significant amounts of solar and wind power are likely to grow over time. Figure 4 shows the role hydrogen storage can play in providing long-term seasonal flexibility for a system with extensive renewable energy. Hydrogen may be best suited to a seasonal storage role particularly through the use of salt caverns and gas networks for storage.

Figure 4: Role of hydrogen in electricity storage, Germany: 95% decarbonisation scenario, 2050

Source: LBST, 2019

Both short-term and longer-term system support and flexibility will depend on the type of hydrogen supply chain and the planned end use of hydrogen. Hydrogen for natural gas blending in domestic networks or for storage may offer more opportunity for flexibility within the NEM than hydrogen export. A recent report by Advisian for the CEFC notes that by 2050 most applications of hydrogen in Australia will be economic. As such there may well be a variety of end-use hydrogen consumers to which hydrogen projects are committed. Some projects may be inclined to provide more flexibility in the NEM than others.

International analysis of the potential for sector coupling

As part of moves towards decarbonisation, international jurisdictions are considering the use of hydrogen as a green fuel in areas such as power generation, transport and industry. There have also been moves to assess how hydrogen can be integrated into the electricity system to provide services such as supply-demand balancing, frequency control, and improvements to reliability and resilience.

A report for the Fuel Cells and Hydrogen Joint Undertaking group examined the potential value for hydrogen projects in providing system services to the power grid in Europe, specifically in France, Germany, Great Britain, and Denmark. The study estimated that the provision of frequency services could account for between 10 and 30 per cent of revenue for a hydrogen plant connected to the grid.

The system services considered in the report included:

- balancing and congestion management

- frequency containment reserves for stability

- distribution grid services.

The figures below estimate the revenue that a 1 MW hydrogen plant installed in Europe could derive from providing one of the services, exclusive of the others. The report concluded that hydrogen would be most valuable in terms of the provision of frequency services.

| Service provided | Potential revenues (k€/MW/year) | Potential revenues (€/MW/hour) |

| Balancing services | 2-17 | 0.23 – 1.94 |

| Frequency control services | 70-224 | 7.99 – 25.57 |

| Distribution grid services | <1 | 0.11 |

The European Commission Hydrogen Strategy was published in July 2020. The strategy notes that the focus for policymakers in relation to hydrogen is to provide an incentivising and supportive policy framework to enable investment in renewable hydrogen.

The United States Department of Energy Hydrogen Strategy was also published in July 2020. The strategy notes that hydrogen has the potential to support reliability and resiliency on the grid through large-scale energy storage, as well as contributing to the amount of responsive load on the grid.

In addition to the Hydrogen Strategy, the US Department of Energy also released a Hydrogen Program Plan. This plan highlights in more detail that the Department of Energy is considering the benefits of the services that hydrogen infrastructure can provide. Examples in the plan include mid-to-long duration energy storage and grid stabilisation services that leverage the dynamic response of electrolysers. The Department of Energy notes that as the electricity grid evolves with higher penetrations of variable renewable energy sources, electrolysers can provide energy storage and other grid services to increase reliability and resiliency.

The UK Hydrogen Strategy was published in August 2021. The strategy is focused on the development of the UK’s hydrogen industry, including demand and production of hydrogen. The strategy notes that the development of hydrogen will require a whole of system approach and suggests that there will be value in hydrogen providing grid balancing services.

The German national hydrogen strategy was published in June 2020. The strategy focuses on the benefits and uses of hydrogen across the economy and notes the potential usefulness of hydrogen as a storage medium for balancing energy supply and demand.

The French national hydrogen strategy was published in September 2020. The strategy focuses on supporting the development of hydrogen in France, with support for research and development. The strategy notes a key role will be developing the use of hydrogen to facilitate the deployment of renewable energy generators by improving the stability of energy networks. In its National Energy and Climate Plan, France noted that key areas of development would include examining the impact of implementing flexibility options such as demand management and hydrogen.

The Danish transmission system operator, Energinet, has published a strategic action plan for the integration of hydrogen into the electricity system. The plan noted that distributed hydrogen can balance local electricity grids and deliver flexibility to the power system. Energinet state that a key factor enabling integration of hydrogen with the grid will be looking at introducing more flexible tariffs. This might ensure system value and costs in connection with the establishment and operation of specific plants are reflected in the costs of using the grid.

The Netherlands government published its national hydrogen strategy in April 2020. The Netherlands Enterprise Agency also published a paper on solutions for a hydrogen economy in March 2021. The national strategy recognises the importance of support schemes for scaling up hydrogen production in the economy. It notes that flexible electrolysers can be used for grid balancing, frequency containment, or as emergency power systems. It speaks to initiatives to promote hydrogen production, usage, and storage to resolve congestion problems in the electricity transportation network, increasing the potential for integration of renewable energy in a decentralised manner.

The Norwegian Government published its hydrogen strategy in June 2020. The strategy notes that effectively incorporating hydrogen into the grid means power grid companies must design their tariffs to ensure the grid is appropriately designed and utilised. It states that grid companies currently have the option to offer reduced tariffs for interruptible consumption.

In summary, international jurisdictions are looking at the value of hydrogen production facilities in supporting the power system, but opportunities for the sector at this stage, are in the early phases of development across the globe.

How the NEM is changing

The power system is undergoing a period of material change. The generation mix is evolving, as are market dynamics through changing load profiles and consumer behaviour. The key changes affecting the system include:

- increasing inverter-based batteries, wind and solar generation online

- fewer synchronous units online with the exit of thermal capacity

- increasing distributed photovoltaic (DPV) generation online

This shift from synchronous generation to variable renewable energy (VRE) generation is occurring rapidly. The Australian Energy Market Operator (AEMO), in its renewables integration study, shows penetration of wind and solar generation in 2025 - under the step change scenario - meeting 100% of underlying demand in some periods. This means increasing proportions of generation in the NEM will be subject to variable environmental conditions that may change quickly across the day.

The rapid uptake of rooftop solar generation, particularly in regions with high penetration rates such as South Australia, is causing a reduction in demand from the grid in the middle of the day.

These trends are expected to continue with continued investment in VRE generation, rooftop solar and retirements of the thermal generation fleet. The development of net zero policies in different jurisdictions will also require additional investment in renewable generation capacity.

These changes have several effects on the NEM:

- Variability and uncertainty. Generation and load will vary more through the day, placing a greater need on dispatchable capacity to vary output at increasingly faster speeds.

- Spot price volatility. Greater price spreads between periods with maximum VRE generation and periods with no or little VRE generation. Increased incidence of negative demand and negative price events

- Frequency management needs increase. The power system is operated closer to its limits with variable, and uncertain, supply and demand, and declines in inertia.

- Voltage management needs increase.

- Lower system resilience to large unit trips or network issues.

- Network constraints and operation. There are limits to how much wind and solar PV generation can operate at any one time in different parts of the network. These limits may differ by NEM region, with some regions already close to limits in some cases and likely to be closer by 2025.

- Greater amount of market direction and intervention required by the market operator.

To the extent a technology like hydrogen electrolysers can help to manage or alleviate these issues, it will provide value to the NEM and receive value in turn where there is a market or other mechanism established for these services.

The power system services hydrogen production facilities can offer the NEM

The requirements of the power system for support from market participants covers the secure and reliable operation of the system, both under normal operating circumstances and when the system is subject to stress, through high demand, or outages of infrastructure and generation.

These services can be categorised as resource adequacy, frequency management, voltage management, network support, network capacity and system restoration.

Network congestion, or the role hydrogen can play in the relief or management of congestion, is the subject of our next article in the series and is not covered in detail here.

Table 2: Power system requirements hydrogen production industry has the potential to provide (system attributes based on AEMO’s power system requirements, July 2020)

| System Attribute | Services | Market mechanisms |

| Resource adequacy |

| Flexible demand – Spot and contract market Retailer Reliability Obligation (RRO) – Avoided cost of alternative contracts under RRO. Reliability and Emergency Reserve Trader (RERT) |

| Frequency management |

| FCAS markets. |

| Voltage management |

| Procured by AEMO through NSCAS process |

| Network support |

| Procured by AEMO through NSCAS process |

| Network congestion |

|

The requirements of each of these services is changing over time, as the system transitions. The services, and the markets and mechanisms by which they are procured are described below:

Resource adequacy

Resource adequacy means that there is a sufficient portfolio of energy resources to achieve the real time balancing of supply and demand.

Bulk Energy

Bulk energy refers to the ability of the system to respond to expected and unexpected changes in supply-demand, and the flexibility of resources to adjust output provided to the market. The dimensions of bulk energy include: the speed of response; the rate output and whether it can be ramped up or down; maximum output, and any minimum generation requirements.

These resources include flexible demand and demand response. This can be in the form of load varying electricity usage in response to market signals, both behind-the-meter resources and large industrial facilities directly connected to the transmission network, such as aluminium smelters or hydrogen electrolysers. Hydrogen projects could also provide bulk energy through on-site storage and generation, depending on project design.

Flexibility is important to the system over a range of timeframes. In the short term, as close as five minutes, flexibility is required to manage variations in demand or the sudden drop-off of generation, such as a reduction in wind or large-scale solar PV output. A more gradual ramping period (two to three hours) may be required as rooftop solar PV generation tails off with the setting sun and consumer demand increases towards the end of the day.

Bulk energy services are effectively valued through spot and contract markets including through power purchase agreements (PPAs) with an energy supplier, with variable break prices for customer demand to turn off.

Hydrogen flexibility could also be valued as a cap or virtual cap contract, where there is an equivalent baseload energy supply contracted to supply the electrolyser in periods where the cap might operate.

Recent rules in relation to wholesale demand response and rules under development as part of the ESB’s post 2025 market redesign are intended to enhance this role. Wholesale demand response and the role of the wholesale demand response service provider (DRSP) came into effect on 24 October 2021, under which the DRSP can bid demand response directly into the wholesale market.

The post 2025 reforms also include the Integration of distributed energy resources and flexible demand. Under the ESB’s DER implementation plan, flexible trading arrangements are intended to make it easier for smaller players to engage with the market. This work should have benefits for hydrogen projects, both large and small.

The role of hydrogen in balancing the system also refers to how hydrogen projects might help the system with minimum demand issues that arise with increasing penetration of solar PV resources. Where demand has flexibility to increase or shift to lower demand periods of the day this provides valuable support in balancing the system.

In April 2022, ARENA published a study by NERA Economic Consulting on the value of load flexibility in the NEM. The study concluded that changes in hydrogen production load factors - a measure of the flexibility electrolysers can provide the system - can reduce system costs by billions of dollars in NPV terms over the modelling timeframe 2021 to 2042. This is achieved by reducing the load factor on the electrolyser. The NERA report looks at the value of a shift from 100% load factor to 85% and from 85% to 60%. This indicates the scale of value hydrogen electrolysers can provide the NEM, noting, that this is contingent on the costs to these projects of providing this additional flexibility.

Operating reserves

Operating reserves can be provided by any asset that is not currently dispatched and is available for dispatch at a future time. Reserves can be provided by inverter-based resources such as wind and solar, as well as synchronous resources such as gas-fired generators and coal plants.

Currently in the NEM, operating reserves are valued implicitly: effectively, the unused capacity of synchronous generators that are generating below full capacity is available to the market. These operating reserves are in-market reserves. There are also out-of-market reserves that are procured through the RERT framework.

The AEMC is considering whether there is a need to explicitly unbundle the procurement of operating reserves from the energy market through two rule changes, one from Infigen Energy and one from Delta Electricity. Both look at introducing explicit reserve services markets in the NEM to help respond to unexpected changes in supply and demand. These rule changes form part of the ESB’s post 2025 workstream on essential system services and scheduling and ahead mechanisms.

Strategic Reserves

Strategic reserves are procured in the NEM through the Retail Reliability Obligation (RRO) and the Reliability and Emergency Reserve Trader (RERT)

The RRO provides incentives for market participants to invest in firming technology in regions where it is needed to support reliability. AEMO identifies reliability gaps in each NEM region in the coming five years using its Electricity Statement of Opportunities (ESOO). If AEMO identifies a material gap three years and three months out, it will apply to the AER to trigger the RRO by making a reliability instrument.

Liable entities must enter qualifying contracts to cover their share of a one-in-two-year peak demand. A registered demand response contract/arrangement can be a qualifying contract. Hydrogen production facilities can play a role in supplying qualifying contracts if a reliability gap is identified.

The RERT is a mechanism by which AEMO may elect to contract for reserves to meet an interim reliability measure. This occurs during periods where the risk of a supply disruption has been indicated. Hydrogen could play a role in the provision of RERT, but only where the load is unscheduled. To be eligible, reserves provided under a reserve contract must not be available to the NEM through any other contract or arrangement in the trading intervals in which the reserve is required.

AEMO uses criteria to assess the reserve including their availability over summer periods, whether they can be activated as a block of not less than 10 MW and whether the reserve can be activated continuously for at least 30 minutes. The RERT market over the last three full financial years is worth between $30m and $50m per annum.

The ESB’s final reform package on post 2025 market redesign includes recommendations to implement a NEM-wide strategic reserve for the procurement of reserves that individual jurisdictions consider necessary beyond existing resources procured under the RERT to meet the reliability standard. These resources would expand the supply of short notice RERT providers available.

Capacity mechanism

Hydrogen and hydrogen fuelled generators may play a key role in the future operation of any Capacity mechanism in the NEM. The ESB is currently carrying out further design work on the proposed mechanism. Draft recommendations for detailed design of the mechanism are due to be published in August 2022.

Frequency management

Frequency management is the ability to set and maintain system frequency within acceptable limits. The services which maintain frequency must collectively provide a continuous response to arrest any deviation in frequency, and then return it to the desired levels.

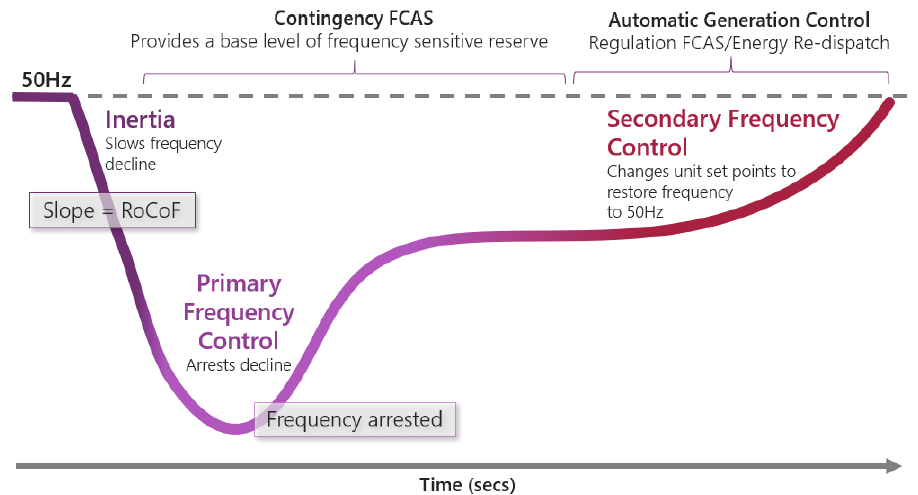

Figure 5: Frequency control services acting to restore power system frequency after a disturbance

Source: AEMO

As shown in the figure above, primary frequency response (PFR) is the first stage of frequency control in a power system. It is the response of generating systems and loads to arrest and correct locally detected changes in frequency by providing a change in their active power output or consumption. The NEM’s normal operating frequency band (NOFB) is currently set between 49.85 Hz and 50.15 Hz. PFR provides a continuum of response and is relevant both outside and within the NOFB.

Outside the NOFB, a minimum amount of headroom and foot room for PFR to respond is procured through the contingency frequency control ancillary services (FCAS) markets (fast, slow, and delayed).

Contingency events, such as the sudden failure and disconnection of a generator or load, can cause a sudden imbalance in supply and demand, leading to a rapid frequency change which can shift frequency outside the NOFB.

Contingency FCAS acts to contain these deviations and coordinate with regulation FCAS to restore the frequency back to normal levels. NEM contingency raise or lower services are specified to act within six seconds for the fast service, 60 seconds for the slow service, and five minutes for the delayed service. The fast service arrests the deviation in frequency and the slow and delayed services replace the fast service to contain frequency for the full five minutes and may also provide some assistance in stabilisation.

Frequency response can be sourced from many types of devices, including synchronous generators, batteries and load. Fast switched loads, such as distributed and large industrial loads, are also able to provide contingency response, usually to raise frequency.

Secondary frequency control is currently managed in the NEM with regulation FCAS services and energy re-dispatch. During normal system operation, regulation frequency control services respond to an external signal from AEMO which fine-tunes their dispatch targets (set points) to correct deviations in frequency within the NOFB. Regulation FCAS bids and offers are co-optimised with energy as part of security-constrained economic dispatch.

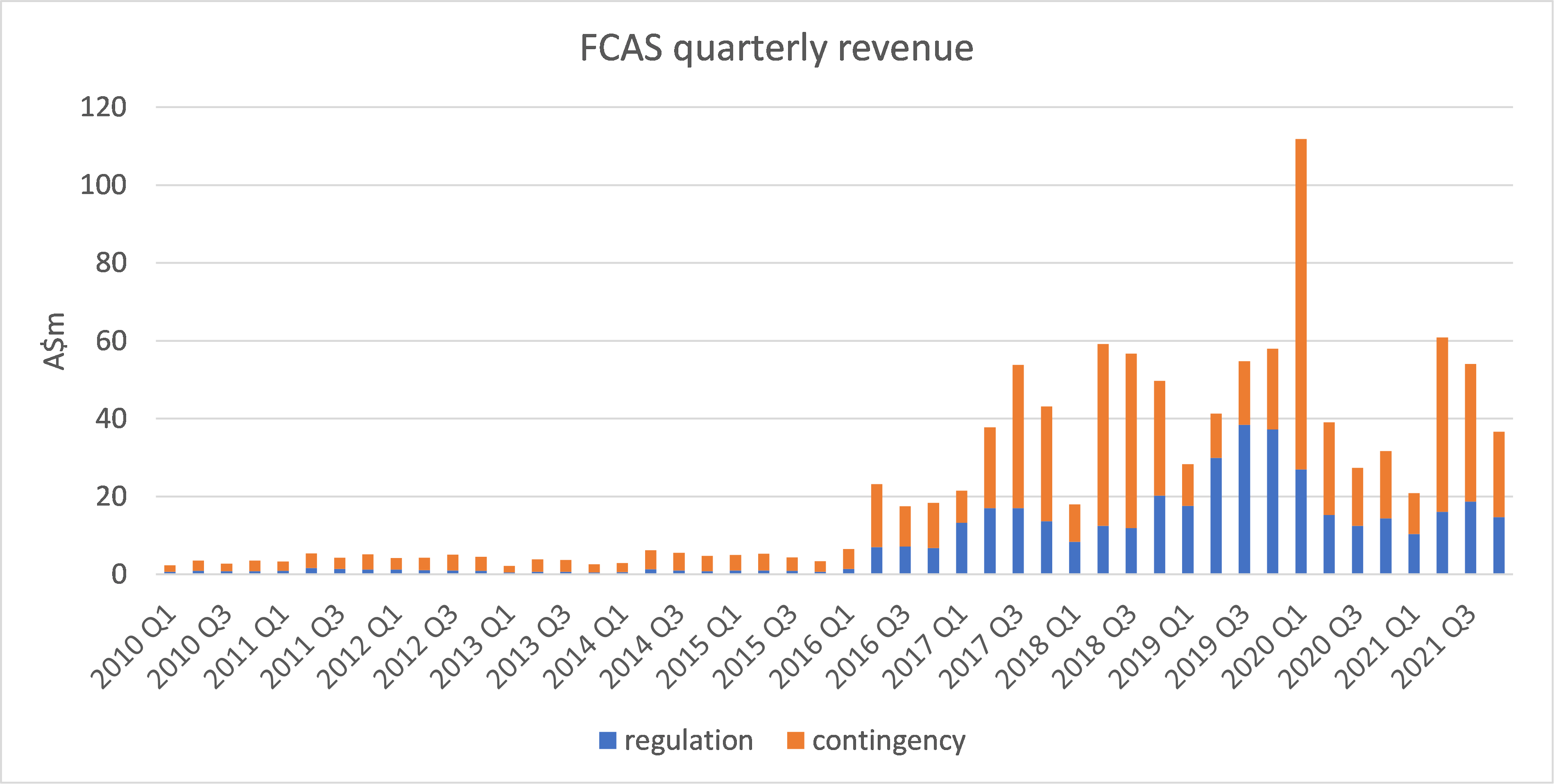

In recent years, as can be seen in the figure below, the market for FCAS has grown considerably.

Figure 6: FCAS market quarterly revenue

Source: AER

As well as large thermal generating units, newer utility scale batteries in the NEM supply this market. Hydrogen production facilities will have an ability to provide raise and lower services as load and raise and lower services as generation when combined with hydrogen storage and generation assets.

Macquarie’s study of Flexibility in Hydrogen Electrolysers in October 2020 noted electrolysers participating in the FCAS markets could help to offset their electricity costs, even without a storage component to the project. The results suggested that up to 30% of electricity costs could be saved through FCAS participation. However, these revenue streams are uncertain.

On 15 July 2021 the AEMC made a final rule to introduce new market ancillary services in fast frequency response (FFR). The services introduced are for very fast raise and very fast lower FCAS in a period of two seconds or less. These arrangements commence on 9 October 2023. FFR is a class of Primary Frequency Response that provides system benefits at low levels of synchronous inertia, and/or very large contingency sizes.

FFR is a relatively new service that can be offered by inverter-based technologies such as wind, solar photovoltaics (PV), batteries and demand-side resources. As such it can be offered by hydrogen production facilities and by integrated hydrogen production, storage and generation facilities.

On 16 September 2021, the AEMC published a draft rule on primary frequency response arrangements that confirms the mandatory primary frequency response requirement as enduring and introduces double sided incentives for plant behaviour that impacts system frequency. This new process would commence in March 2024. Scheduled loads will have an opportunity to be paid for the provision of primary frequency response services under the draft rule. Where a hydrogen electrolyser opts to be scheduled it would therefore have an opportunity to be recompensed for the provision of this service.

Under the AEMC’s Integrating Energy Storage Systems into the NEM rule change, published in December 2021, the creation of an additional registration category, the Integrated Resource Provider (IRP) allows participants that are both load and generation, such as storage, to participate in a single registration category. Aggregators in this new category will also be able to provide market ancillary services from generation and load. The rule will come into effect on 3 June 2024 and will facilitate market participation for facilities that are both generation and load.

FCAS services can be offered by scheduled load participating in the wholesale energy and FCAS markets. A hydrogen electrolyser facility would be registered as a market load and would need to submit bids to the Australian Energy Market Operator (AEMO) to receive market awards for products such as energy and FCAS.

Hydrogen electrolyser load may also play a role in providing FCAS in areas with high concentrations of VRE resources. AEMO in its frequency control workplan is prioritising regional FCAS requirements in relation to contingency and regulation FCAS.

Network Support

Non-market ancillary services (NSCAS) are procured to control power flow into or out of the transmission network, to address two needs:

- Maintain power system security and reliability of the transmission network. This is referred to as Reliability and Security Ancillary Service (RSAS). RSAS can be provided by generators, TNSPs, and market customers.

- Maintain or increase power transfer capability of the transmission network. This is referred to as Market Benefit Ancillary Service (MBAS). MBAS can be provided by generators, TNSPs and market customers.

To provide RSAS, AEMO can contract for Non Market Ancillary Services (NMAS) such as generators and energy storage for voltage control. Where AEMO identifies a gap in the required service level, AEMO may then request the relevant TNSP to put arrangements in place to meet the gap. AEMO can also procure RSAS itself through the NSCAS tender process. RSAS may need to be location specific to have the desired effect.

MBAS is a non-market ancillary service procured to increase the power transfer capability of the transmission network. It can be purchased to address limits in relation to thermal transmission, voltage and voltage stability. Examples of providers of MBAS are synchronous condensers, generators with power system stabilisers, reactive plant, virtual transmission lines and controllable customer load.

AEMO reviews system constraints to determine solutions. This can include historical constraints, constraints identified in the ESOO and ISP and constraints identified by market participants. AEMO then conducts a cost benefit assessment to determine if investment in MBAS is needed. AEMO may report a MBAS gap and then request the relevant TNSP to put arrangements in place to meet the gap. Hydrogen electrolysers as controllable customer load will likely have an ability to provide these services.

Recent work on the operational security mechanism, or options for the scheduling and provision of essential system services to ensure the power system remains secure, is also aimed at addressing these issues. In September 2021, the AEMC published a directions paper on these mechanisms. The directions paper addresses two rule changes received by the Commission from Hydro Tasmania and Delta Electricity concerning valuing, procuring and scheduling essential system services.

The directions paper sets out a framework for considering two broad options for how these services can be procured:

- market ancillary services (MAS) approach – which would introduce new services to be scheduled through the pre-dispatch engine to allow it to produce dispatch schedules that result in secure dispatch, and

- non-market ancillary services (NMAS) approach – which would introduce new services to be procured and scheduled in an optimisation approach outside of the spot market, to ensure secure dispatch in a more efficient manner.

The Commission is currently working through the details of these two options, with a draft determination scheduled for publication on 30 June 2022.

Resilience

Hydrogen has a role to play in providing system resilience, particularly in a system that is decarbonising.

‘Without hydrogen a decarbonised energy system based on electricity would be much more flow based. Flow-based energy systems must match demand and supply in real time, across wide distances, and can be vulnerable to disruptions in supply. Chemical energy can add a stock-based element to an energy economy and thus contribute significantly to energy system resilience.’

IEA report for the G20 in Japan June 2019, The Future of Hydrogen

The role that hydrogen production can play in providing resilience relates to both the flexibility of the load in helping to match supply and demand on the system and the chemical store of fuel that can be used to generate electricity over extended timeframes either via a fuel cell or a gas generator with the ability to use hydrogen as fuel.

Conclusion

Hydrogen electrolysers can provide significant flexibility to electricity systems and markets. Certain types of flexibility may be more suited to hydrogen production than others, depending on the project design and the end use of the hydrogen produced. Turndown capability for within day or short-term system requirements may provide significant value. Long-term energy storage provision or matching predictable changes in renewable output or seasonal variations, subject to electrolyser capacity factor requirements, also presents opportunities for sector coupling.

The recent study published by ARENA on valuing load flexibility in the NEM put the value of load flexibility from hydrogen production in the billions, noting this value increases in “more ambitious states of the world” with higher penetrations of VRE and has a favourable impact on the emissions intensity achievable in the NEM.

Internationally, a number of countries have been looking at the scope for sector coupling, but these efforts are still in the early phases of development.

The hydrogen production industry in Australia can derive additional revenue from providing system services, thereby improving business cases and strengthening the competitiveness of hydrogen produced in Australia. Sector coupling, rewarding hydrogen for the services it provides to the NEM is one way in which the Australian hydrogen production industry may be able to maintain a competitive advantage longer term.

The existing regulatory frameworks in the NEM already support this sector-coupling role. Recent work and work under way will further support this role, particularly in relation to frequency management services and flexible or dynamic demand.

Future work of the AEMC will need to increasingly consider the role of Hydrogen electrolysers in the NEM. Hydrogen and hydrogen fuelled generators may also play a key role in the future operation of any capacity mechanism. We look forward to future engagement with industry and government stakeholders alike as the industry progresses in its development across the Australian continent.

The Commission is already actively engaged with industry stakeholders on the Hydrogen review in relation to gas market frameworks. For further information on this key reform for the development of the hydrogen sector, stakeholders can access the project page and draft report, as well as the draft determination on the related DWGM connected facilities rule change.