Grid access reform could create detailed wholesale price signals for battery investment and operation in the NEM

Orrie Johan, Tom Meares and Russell Pendlebury

Introduction

The recent history of large-scale battery deployment in the national electricity market (NEM) and in overseas markets is one of rapidly declining costs, increasing interest in the technology and a few landmark early developments. However, the scale of projects built to date is small compared to the pipeline of projects proposed globally, particularly in US markets. It is also small relative to the penetration of intermittent renewable generation that is likely to benefit from complementary firming technology, particularly in the context of the rapid growth in utility scale solar and wind development in the NEM. Recent announcements on future utility scale battery projects in the NEM reflect the scale of potential investment in the coming years.

Batteries can be more rapidly deployed than traditional firming capacity that is used to augment renewables when the sun isn’t shining and the wind isn’t blowing and are perhaps more flexible in terms of location. The deployment of batteries would appear to benefit from specific price information in relation to where it should or should not be located. Locational marginal prices (LMPs), as would be provided under transmission access reform in the NEM, will provide batteries with more granular information in relation to:

- concentrations of generation, in particular intermittent generation;

- concentrations of load;

- constraints on the transmission network; and

- volatile prices at specific points on the network as a consequence of the interaction of the first two factors with the third.

A single regional reference price by comparison provides information to an entire region relating to the single reference node, which is used to calculate the regional reference price.

The extent to which generation resources and load are unevenly spread through the network, and the extent to which the system is transitioning has a direct bearing on the value of location specific prices in the market over time. Batteries, perhaps more than any other technology, would seem to be reliant on more granular price signals for whether to invest, where to invest and how to operate. A single regional reference price by comparison delivers less information, and less clear incentives, to investors about where and when to invest in battery technology.

This paper seeks to shed light on the extent to which locational specific prices may aid the deployment of battery technology in the future, through a period of declining costs and the continuing build of renewable generation across the transmission network.

The California market in the US is looked at in brief, and in particular the forward battery build program, given the degree of battery capacity proposed in this region is far greater than in any other region in the US. California implemented locational marginal prices in 2009.

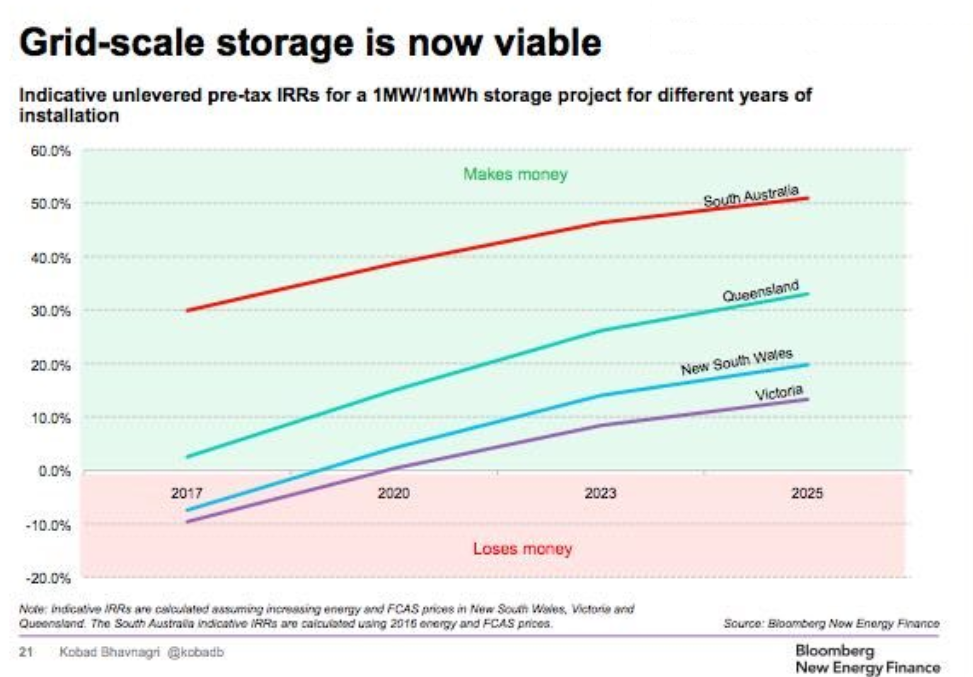

Costs will continue to change and this in its own right will no doubt be a key factor in battery deployment across the NEM. So too will the operation of frequency control ancillary services (FCAS) markets, which have to date provided batteries with much of their underlying business case, or the introduction of other system services, such as fast frequency response. However, the principal aim of this paper is to answer the question of whether location specific price information, and incentives, may be an aid to the deployment of batteries, and in particular, the deployment of batteries where they can provide the greatest benefit to the market, the transmission network and consumers as a whole.

Transmission access reform and the business case for battery technology

The investment and operational case for a battery is derived from several markets. Some of the most notable options are:

- providing system services, such as frequency regulation, voltage support or reactive power support;

- co-located firming of generators such as wind or solar farms;

- transmission and distribution investment deferral by managing the load on the transmission or distribution level below its specified maximum level;

- arbitrage in the wholesale market for energy, where batteries charge using inexpensive electrical energy and discharge when prices for electricity are high. This option allows large-scale batteries to alleviate congestion on the transmission network (just as they would for transmission deferral), but does so through responses to price incentives whether these are regional prices or locational marginal prices.

- peak demand lopping for significant loads; and

- providing virtual cap products for significant loads that would otherwise purchase these products directly or indirectly from the contract market.

Transmission access reform introduces locational marginal prices for scheduled generation and load in the place of a regional reference price. This has the potential to provide a more granular price signal across the transmission network for battery deployment. This price signal can help to indicate the best place to deploy battery technology to defer expansion of the transmission network by helping to alleviate constraints at particular times of the day. This is particularly useful through a period of rapid growth in renewable technology deployment, where a significant amount of renewable capacity may have been added in parts of the network with limited transmission capacity.

Under a system of regional prices, locational signals for the deployment of batteries are much more limited, being confined only to a single regional reference node for each region. Where a battery acts to relieve a system constraint in such a market, it may be under-compensated for the role it plays in alleviating congestion by being settled at the regional reference price.

Batteries in the NEM have to date been built primarily with a view to participation in the FCAS market in order to recoup investment costs. However, as this market becomes better supplied with battery capacity, the deployment of increasing amounts of battery storage to help support the transition of the energy system to a higher share of renewables will increasingly need a clear wholesale price arbitrage investment signal in order to support the continued business case for additional investment. Indeed, some battery storage owners have indicated that arbitrage may become an increasingly important portion of their battery’s overall revenue stream, relative to the revenue derived from providing FCAS services.

Price signals for battery investment and operation in the NEM today (in $/MWh)

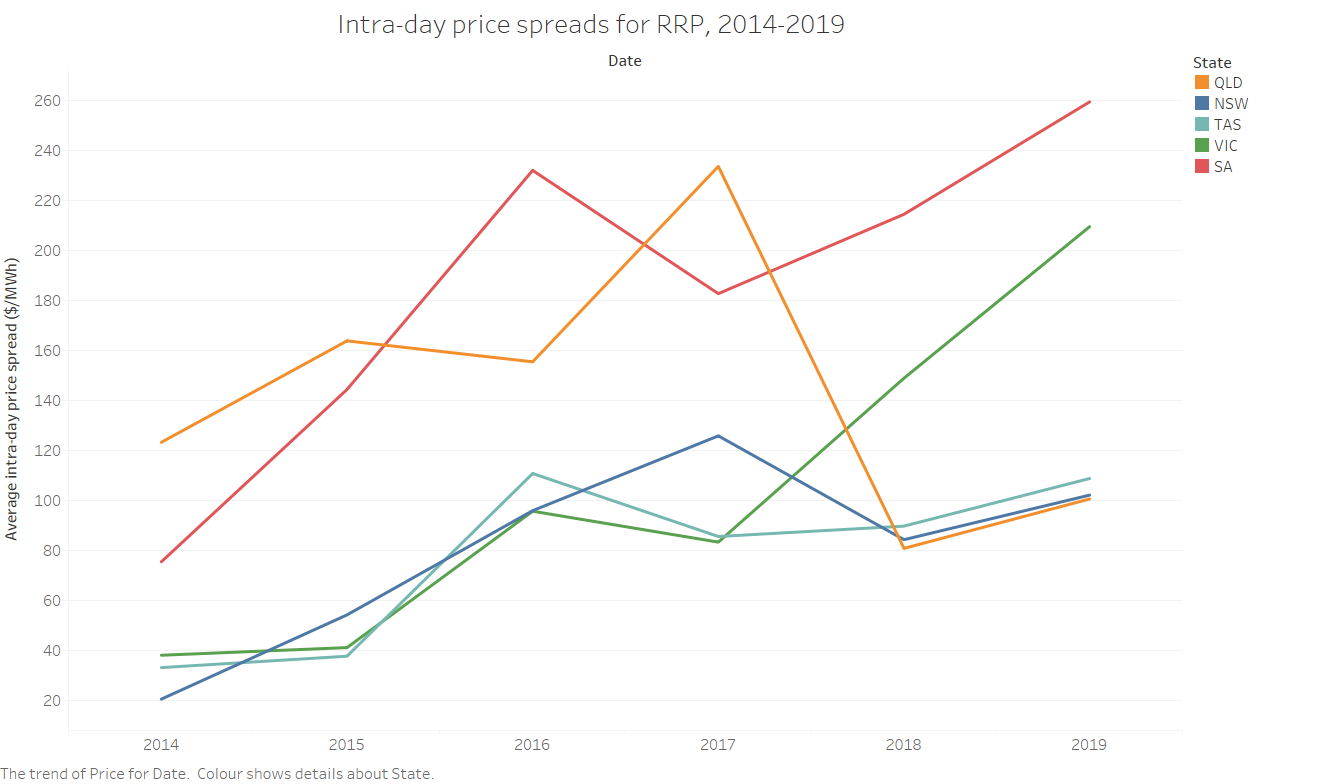

Notes: Average daily intra-day price variation. Highest consecutive two-hour period compared to the lowest consecutive two-hour period, based on 5-minute dispatch data.

Source: AEMC Analysis of MMS Database, NEM Regional Reference Price data, 2019

The chart above reflects the average intra-day price variation in the five regions of the NEM, between the top two price hours in the trading day versus the bottom two. In other words, with perfect foresight over the course of 2019, this is the revenue in $/MWh that a 2-hour duration battery might have derived from the market in each region per day.

There are a number of things to note about this. First, there are only five signals. Second, there is a significant difference between the signal in some regions to others. The signal in South Australia is more than double the signal in Queensland. As was noted in the introduction, wholesale arbitrage is not the only market a battery will have recourse to in justifying its business case. However, this wide disparity reflects the importance of locational signals in finding a region of the NEM with a strong wholesale price arbitrage signal for battery deployment.

The chart below reflects the degree to which this signal changes from year to year. The signal in each region has varied significantly, except in South Australia where it has been strong relative to other regions for the past five years.

Notes: Average daily intra-day price variation. Highest consecutive two-hour period compared to the lowest consecutive two-hour period, based on 5-minute dispatch data.

Source: AEMC Analysis of MMS Database, NEM Regional Reference Price data, 2014-2019

Price signals in the NEM under shadow locational marginal prices (in $/MWh)

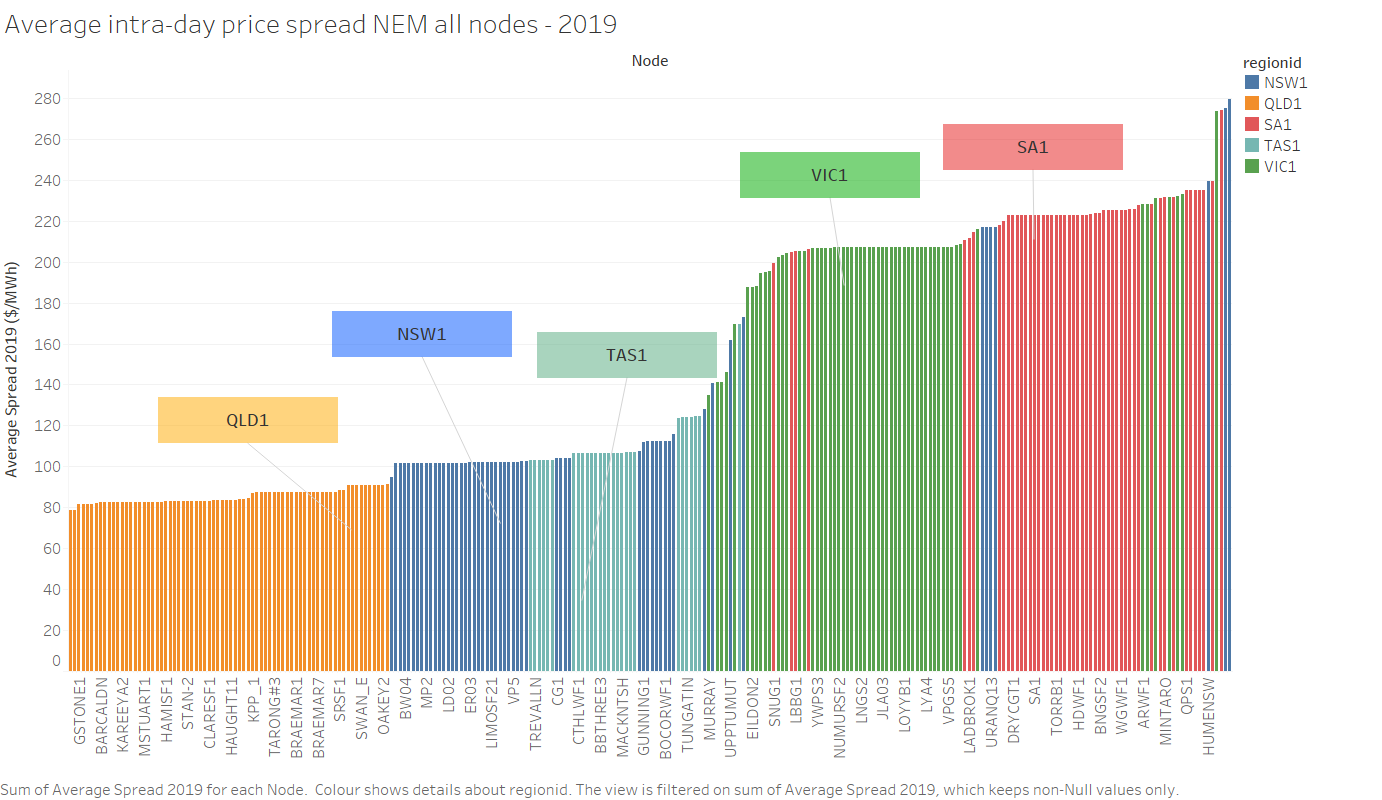

While the NEM settles based on regional references prices currently, AEMO’s dispatch engine also calculates shadow locational marginal prices for all trading intervals. Using these prices, we are able to show the shadow locational marginal prices for the NEM over the same time period, 2019, as is reflected in the chart above.

Notes: Average daily intra-day price variation. Highest consecutive two-hour period compared to the lowest consecutive two-hour period, based on 5-minute dispatch data. Prices at the market price floor of -$1000/MWh are removed.

Source: AEMC modelling, based on AEMO MMS database, 2019

There are a number of things to note from this chart. First, there are many more locational marginal prices or price points to establish whether additional battery investment is required in a region. Second, there is more information provided on where a battery should locate within a region. Third, while some regions in using a single regional reference price might not see a strong arbitrage investment signal, most regions appear to have nodes at the higher end of the arbitrage signal spectrum.

Summary of LMP price signals by region under shadow locational marginal prices (in $/MWh)

|

Region |

Average Price Spread Low |

Average Price Spread High |

Difference |

|

NSW |

95 |

280 |

185 |

|

QLD |

79 |

91 |

12 |

|

SA |

199 |

274 |

75 |

|

TAS |

103 |

170 |

67 |

|

VIC |

135 |

274 |

139 |

Source: AEMC modelling, based on AEMO MMS database, 2019

The table above summarises the difference in the highest and lowest nodes in terms of average intra-day price spread over 2019, using the same data as the previous chart. In some regions, the higher spread shadow locational prices represent a significant difference in arbitrage opportunity from the lower spread shadow locational prices.

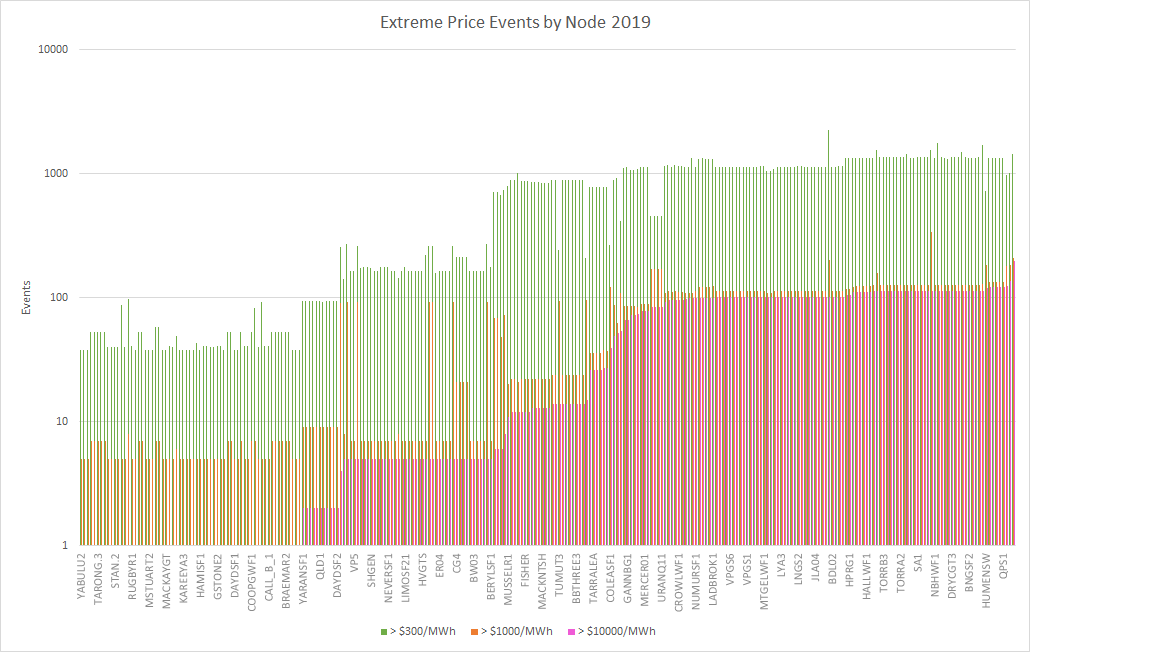

Incidence of high price events under shadow locational marginal prices (number of events)

Source: AEMC modelling, based on AEMO MMS database, 2019

It is not only the average spread over a year that provides the investment signal for battery deployment. Extreme price events, or prices above $300/MWh and higher can provide clear signals for battery deployment. Using the same data set, the chart above displays the count of extreme 5 minute price events for each shadow LMP in the NEM over 2019, using a logarithmic scale. Approximately one third of all locations have more than 1000 price events over $300, and approximately one third of all locations have more than 100 price events over $10,000, with a potentially significant impact on the incentives for battery deployment.

While the existing regional signal is variable from year to year, with many more LMPs for a battery to operate off, it seems more likely that some of these high price variation nodes will exhibit more persistent price variation signals for battery deployment than the regional reference node.

It should be noted that these prices are not the prices that market participants are currently subject to. Once exposed to their locational marginal prices, bidding behaviour is likely to change, and with it locational marginal price outcomes.

Spot market prices do not act alone in providing signals for new capacity, either in relation to storage, generation or demand response investment. Prices in both the spot and contract market provide signals for new investment in dispatchable capacity, as well as information about the balance of supply and demand across different places and time. The contract market provides a mechanism for retailers and generators to manage their exposure to spot prices, it lowers the cost of financing for new dispatchable capacity and it underwrites retailers fixed price offers to end consumers. Locational marginal prices in the spot market, in concert with existing contract market arrangements, can help to incentivise new dispatchable capacity, in the process supporting reliability across the system as a whole.

The build out of utility scale batteries to date in the NEM

In Australia, large-scale battery storage deployment is still in its early stages. There are currently five registered battery storage systems in excess of 1 MW capacity.

These five systems are:

- the Ballarat Energy Storage System in Victoria;

- the Gannawarra Energy Storage System in Victoria;

- the Hornsdale Power Reserve in South Australia;

- the Dalrymple North Battery Energy Storage System in South Australia; and

- the Lake Bonney BESS1 in South Australia.

The drivers behind each of these large-scale batteries vary. The Ballarat Energy Storage System’s construction was motivated in large part by locational considerations, as it was expected to be able to ease constraints on transmission lines in Western Victoria that reduce the output of wind and solar-generated electricity. It was also commissioned to provide FCAS services.

The Gannawarra Energy Storage System was commissioned in North-Western Victoria to participate in energy price arbitrage and provide FCAS services, though the possibility of using the battery to reduce curtailment of future renewable energy generation on a relatively constrained line has also been noted.

The Hornsdale Power Reserve battery in Mid-Northern South Australia, installed as part of the South Australian Government’s energy policy to accelerate the roll-out of grid-scale energy storage, has been noted to provide a backup source of electricity, provide FCAS services and participate in price arbitrage using spot market prices. Another rationale for the battery was noted to be the extended support for the Heywood interconnector by alleviating system security constraints.

The Dalrymple North battery on South Australia’s Yorke Peninsula focuses on providing reliability in the case of islanding and FCAS to reduce constraints on the Heywood interconnector and improve system security by quickly injecting electricity into the transmission network following a disturbance.

The Lake Bonney battery in South Australia has been commissioned with the intent of firming nearby renewable generation and providing FCAS services.

Planned large-scale battery storage in Australia

A number of additional large-scale battery storage projects are being considered for Australia. In September 2018, the Smart Energy Council outlined five stand-alone large-scale batteries in varying stages of development across the NEM. The Clean Energy Council also recently identified 15 projects that would mostly be co-located with generation.

Declining capex costs are one of the major factors increasing the growth of utility-scale battery storage growth in Australia. The costs associated with these devices has plummeted over the past decade, making utility-scale battery deployment increasingly viable across the NEM.

Battery energy storage systems (BESSs) as designated “virtual transmission lines”’ in Australia

Most of the aforementioned batteries have predominately been developed to alleviate congestion in addition to providing system services like FCAS provision, firming renewable energy or peaking services, with the choice of function being entirely at the discretion of the battery owner. However in Australia, as in the United States, BESS systems are also being contemplated in a regulatory context to be funded by consumers and obtained by transmission network service providers primarily as an alternative to building additional transmission infrastructure. This concept of BESSs as transmission assets that assist with alleviating congestion, and can only participate in the energy and/or FCAS markets using the non-reserved capacity of the battery, has been referred to as a form of “virtual transmission”, due to its ability to add capacity on transmission corridors.

Two BESS options were considered as part of the regulatory investment test for transmission on near-term solutions to increase transmission capacity between NSW and Queensland. However, neither of these options were pursued further. However, TransGrid and Powerlink as the transmission network service providers in these cases are set to continue to consider virtual transmission options as part of longer-term options for increasing inter-regional capacity between the two states.

Locational marginal prices in providing granular price signals across the transmission network effectively provide a clearer market signal for where virtual transmission in the form of utility-scale battery storage should be deployed.

The battery experience of the California market and the role of LMP

Battery deployment in the NEM and California

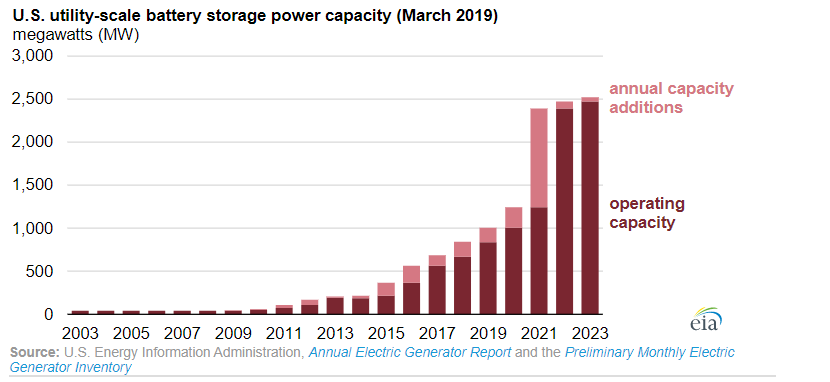

The rapid increase in utility-scale battery storage across the United States in recent years has been one of the defining changes to the country’s energy sector. US utility-scale battery storage reached 1000MW in 2020. Installed utility scale battery technology is set to increase significantly in the next 12-24 months.

Source: https://www.eia.gov/todayinenergy/detail.php?id=40072

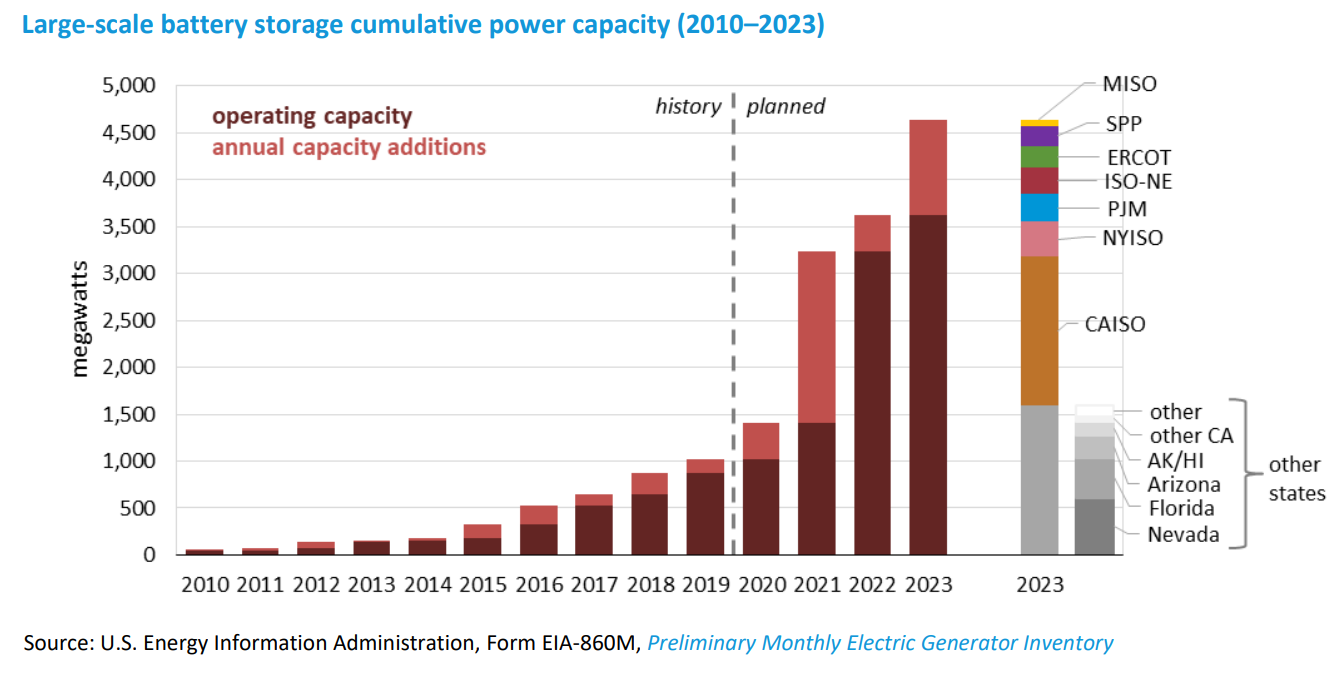

The major change in interest in new large-scale battery installations has led the US Energy Information Administration (EIA) to adjust its expected battery capacity figures over the past year. It is now expecting the U.S. to have nearly 1,500 MW of operating capacity in 2021 (versus the estimate provided last year of 1,250 MW in the same timeframe), around 3,250 MW in 2022 (the EIA previously expected around 2,300 MW to be operational in 2022) and around 3,600 MW in 2023 (the EIA previously expected around 2,400 MW to be operational in 2023). The revised figures published in July 2020 are shown in the chart below.

Source: https://www.eia.gov/analysis/studies/electricity/batterystorage/pdf/battery_storage.pdf, p. 26

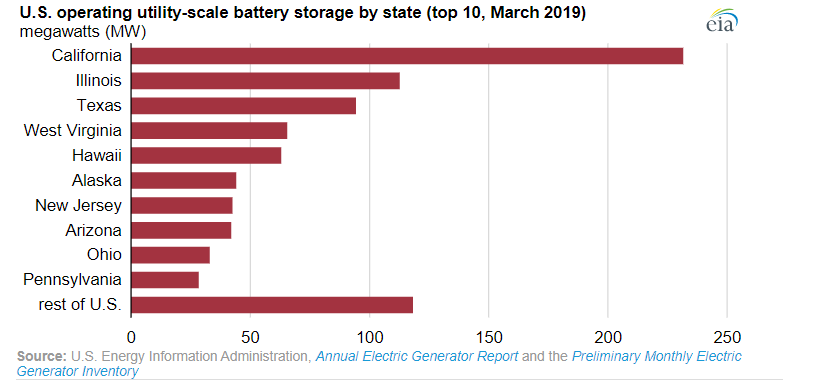

This upward trend has not been proceeding evenly across the country. The national-scale trend hides the fact that some states have a much higher share of the utility-scale battery storage units than others. As can be seen in the figure below, California as of March 2019 has nearly twice the operational battery storage capacity of the bottom 40 states in the US combined.

Source: https://www.eia.gov/todayinenergy/detail.php?id=40072

Many of the US states that have the most operational battery storage units today are also the states that are expected to experience the most increased growth in additional units during the early-mid 2020s.

US regions with either high battery deployment to date or high forecast future deployment tend to be regions that have instituted locational marginal pricing, although it should be noted, most of these regions have strong explicit incentives in place for battery deployment, in addition to locational marginal pricing.

California implemented locational marginal prices in 2009. California has the largest amount of installed utility scale battery of any region of the US, and the largest proposed build out program. California also has a number of policies to incentivise utility scale batteries. It is this large build program of batteries and the locational marginal pricing regime in place that leads us to examine this market for the role LMP might play in the future deployment of utility scale battery technology in the NEM.

The California build program

The total forward build program in California for battery technology as provided by the California Public Utility Commission (CPUC) interconnection queue is almost 9 GW in total as of the close of 2019, shown in the table below.

A large proportion of battery build proposed is proposed to be co-located with generation developments such as Solar.

| Battery Storage Type | RESOLVE Portfolio | Method | % Standalone | % Hybrid (co-located) |

||

| High Confidence (MMA) | 1,215 | Full amount of commercial interest | Not available | Not available | ||

| High Confidence (non-MMA) | 1,977 | Full amount of commercial interest | 26% | 74% | ||

| Moderate Confidence | 2,739 | Percentage of the portfolio total | 19% | 81% | ||

| LCR Area solutions | 2,942 | Percentage of the portfolio total | 68% | 32% | ||

| Total | 8,873 | |||||

Source: ftp://ftp.cpuc.ca.gov/energy/modeling/BusbarMapping-Results-Battery-2020-03-30.xlsx

The list below shows the shortlist of candidate developments considered “High Confidence” to proceed.

|

Sub Station |

MW Allocated (total) |

Average Price Spread |

|

Red Bluff |

791 |

55.51 |

|

Kramer |

637 |

65.36 |

|

Colorado River |

595 |

68.22 |

|

Tesla |

448 |

56.27 |

|

Whirlwind |

200 |

64.02 |

|

Gates |

180 |

57.80 |

|

Westley |

105 |

62.86 |

|

Cool Water |

72 |

67.34 |

|

Sloan Canyon |

40 |

58.61 |

|

Hassayampa |

20 |

60.14 |

|

Victor |

0 |

65.22 |

|

Vincent |

0 |

64.84 |

|

Manteca |

0 |

60.83 |

|

Magunden |

0 |

60.81 |

|

Cortina |

0 |

60.70 |

|

Eldorado |

0 |

58.88 |

|

Midway |

0 |

58.03 |

|

Los Banos |

0 |

56.48 |

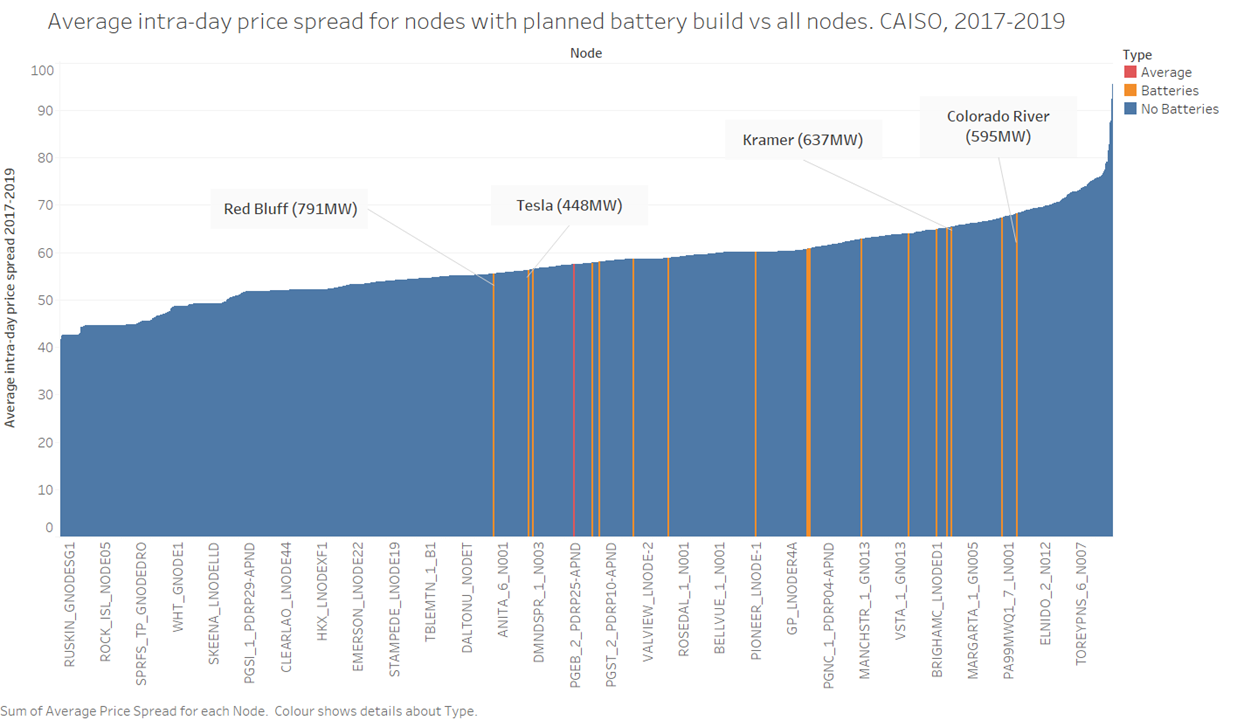

When this shortlist is plotted on the chart of price variation outcomes at California locational marginal prices evident over a two and half year period, from 2017 to the end of 2019, it can be used to reflect whether batteries are in general planned at higher value price arbitrage nodes versus others, using historical prices.

Notes: Average daily intra-day price variation, in $/MWh. Highest hourly period compared to the lowest hourly period. Californian data is hourly. The nodes highlighted as “Batteries” are the nodes identified in the CPUC mapping as nodes where projects were considered to be “High Confidence”.

Source: California ISO Open Access Same-time Information System (OASIS), Locational Marginal Prices, 2017-2019

Regardless of whether batteries are co-located or standalone, and many of the developments shown above are co-located, it appears that the majority of projects in the CPUC’s high confidence category to proceed are proposed at locations with above average intra-day price variation. This may reflect the fact that batteries tend to be co-located with renewable generation developments such as Solar. The question is then whether price variation is likely to be higher at high solar or renewable energy generation nodes.

Conclusions

There are a number of drivers behind the business case for a new large-scale battery development. This may be tax credits available in some markets, FCAS in the NEM or potential future markets in the NEM such as fast frequency response. One of the markets available to support a battery investment case in the NEM both today and in the future is the arbitrage energy market, or the difference in the minimum price that a battery can charge at and the maximum price that a battery can discharge into the energy market.

Locational marginal prices provide batteries, which can opt to both charge and discharge at their locational marginal prices, with a more granular price signal in the market. This more granular signal may indicate the concentration of load in a particular location, or renewable generation, or system constraints.

Price information from the California market suggests that the significant build program of batteries coming up tends to be at the higher end of the curve of historical price variation. This may not be the driver of the decision for where the battery is located; it may reflect the fact that batteries are proposed in areas with more renewable generation and where there is more price variation as a consequence. It may also reflect the role batteries can play in providing resilience in local pockets of the network, where a lack of resilience to date may in part be reflected in wider price variation.Price information for the NEM, in terms of actual regional prices in recent times and shadow nodal prices, demonstrates that regional reference prices do not reflect the value of a battery to the network and the market at particular points in the network.

In some regions of the NEM in recent times, New South Wales for example, the price signal to support battery investment for the purpose of energy arbitrage appears weak at a regional level. But this is misleading. From the more granular pricing data, it can be seen that there are locations within the region where battery deployment would earn a significantly greater return than at the regional reference node, from wholesale price arbitrage. In the process such batteries would likely provide value to the system as a whole in certain pockets of the network within that region.

While battery deployment in the NEM has to date been driven by markets other than wholesale price arbitrage, particularly FCAS, this may not always be the case. A stronger, clearer wholesale signal at certain points of the grid will help in their deployment, and perhaps also in the further roll out of renewables.

Battery storage deployment driven by more granular wholesale prices across the network may also help to defer expensive transmission investment. Recent research focusing on several LMP markets in the United States found that transmission constraints present valuable opportunities for storage. This was found to be the case in particular in the Electricity Reliability Council of Texas (ERCOT) market, where the configuration of the market with significant renewable generation located away from load presents opportunities for storage associated with transmission constraints.

With a greater implied difference in the price variation between locational marginal prices in the NEM versus the California market, it is possible that the nature of the NEM market and grid is such that it may benefit more than the California market from the locational signals provided by LMP.

While the persistence of any price signal may be key to a battery investment case, the presence of more nodes to price off, is likely to provide more opportunity for clearer price signals to persist at particular points in the network.

This initial analysis suggests further work and investigation is required of the likely business case for battery wholesale arbitrage at some of the greater price variation nodes in the NEM. It would be advantageous to see how these signals vary over time, understanding that the locational signals at the moment are not actual market price outcomes, and also to investigate why price signals at some locational marginal prices in particular regions are so much greater than the signal provided by the regional reference node alone.

Further analysis should also focus on the extent to which deployment at high price variation LMPs would still permit the investor to access all the other markets likely to justify the batteries’ investment case, including FCAS, virtual caps, and future markets such as fast frequency response.

Note: We thank Gordon Leslie for sharing his ideas in relation to nodal prices and battery investment signals in the NEM